42 how to calculate coupon rate from yield

Coupon Rate Formula | Step by Step Calculation (with … The term “ coupon rate Coupon Rate The coupon rate is the ROI (rate of interest) paid on the bond's face value by the bond's issuers. It determines the … Yield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · To calculate the bond's coupon rate, divide the total annual interest payments by the face value. In this case, the total annual interest payment equals $10 x 2 = $20. The annual coupon rate for ...

Current Yield of a Bond - Meaning, Formula, How to Calculate? = Annual coupon payment / Current market price = 100/ 950 = 10.53%; Scenario #2: Premium bond Premium Bond A premium bond refers to a financial instrument that trades in the secondary market at a price exceeding its face value. This occurs when a bond’s coupon rate surpasses its prevailing market rate of interest.

How to calculate coupon rate from yield

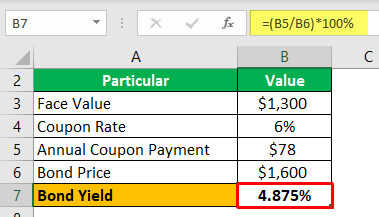

Coupon Rate of a Bond (Formula, Definition) | Calculate ... The bond price varies based on the coupon rate and the prevailing market rate of interest. If the coupon rate is lower than the market interest rate, then the bond is said to be traded at a discount, while the bond is said to be traded at a premium if the coupon rate is higher than the market interest rate. Coupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ... Bond Yield Formula | Step by Step Calculation Here we have to understand that this calculation completely depends on annual coupon and bond price. It completely ignores the time value of money, frequency of payment, and amount value at the time of maturity. Step 1: Calculation of …

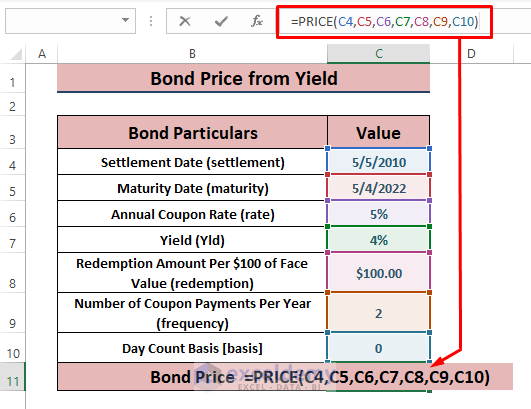

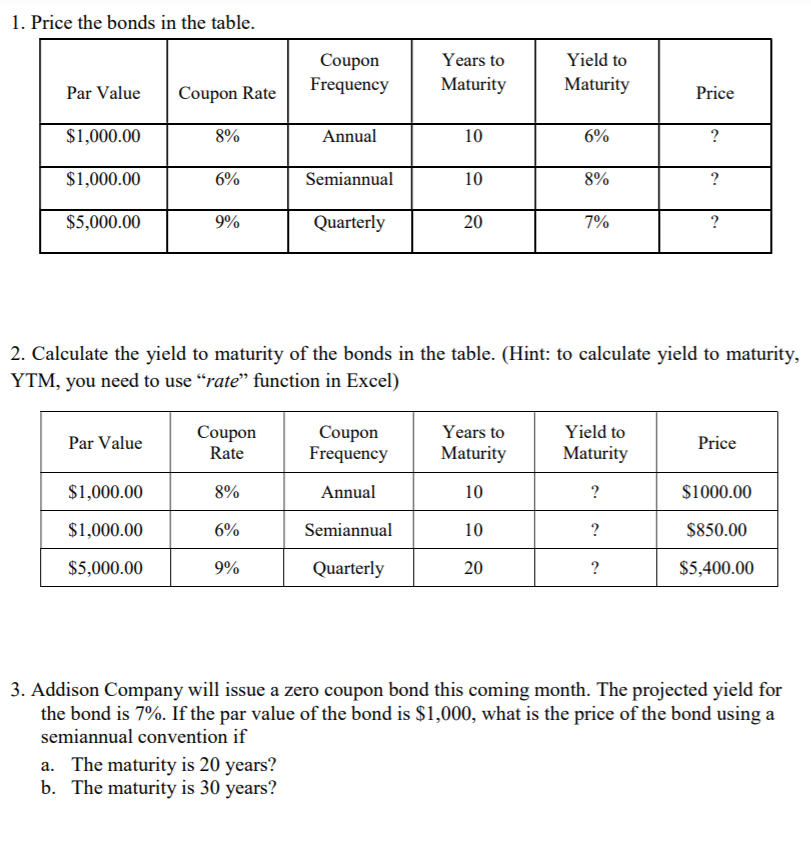

How to calculate coupon rate from yield. How to calculate yield to maturity in Excel (Free ... - ExcelDemy Sep 14, 2022 · How to Calculate Yield to Maturity (YTM) in Excel 1) Using the RATE Function. Suppose, you got an offer to invest in a bond. Here are the details of the bond: Par Value of Bond (Face Value, fv): $1000; Coupon Rate (Annual): 6%; Coupons Per Year (nper): 2. The company pays interest two times a year (semi-annually). Years to Maturity: 5 years. Coupon Rate Calculator | Bond Coupon 15.07.2022 · The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value. For … Coupon Rate Formula | Simple-Accounting.org 12.05.2020 · A bond’s coupon rate can be calculated by dividing the sum of the security’s annual coupon payments and dividing them by the bond’s par value.As a simple example, consider a zero coupon bond with a face, or par, value of … Coupon Rate and Yield to Maturity | How to Calculate Coupon Rate 14.06.2018 · The coupon rate represents the actual amount of interest earned by the bondholder annually while the yield to maturity is the estimated total rate of return of a bond, assuming …

Current Yield Formula | Calculator (Examples with Excel … Step 1: Firstly, determine the annual cash flow to be generated by the bond based on its coupon rate, par value, and frequency of payment. Step 2: Next, determine the current market price of the bond based on its own coupon rate vis-à-vis the … How to Calculate Yield to Maturity: 9 Steps (with Pictures) May 06, 2021 · Estimate the interest rate by considering the relationship between the bond price and the yield. You don’t have to make random guesses about what the interest rate might be. Since this bond is priced at a discount, we know that the yield to maturity will be higher than the coupon rate. What Is Coupon Rate and How Do You Calculate It? 26.08.2022 · The coupon rate is calculated by adding up the total amount of annual payments made by a bond, then dividing that by the face value (or “par … Coupon Rate: Formula and Bond Yield Calculator - Wall … The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond; For example, if the coupon …

Zero Coupon Bond Value Calculator: Calculate Price, Yield to ... Here is an example calculation for the purchase price of a $1,000,000 face value bond with a 10 year duration and a 6% annual interest rate. 20. Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P ... Bond Yield Formula | Step by Step Calculation Here we have to understand that this calculation completely depends on annual coupon and bond price. It completely ignores the time value of money, frequency of payment, and amount value at the time of maturity. Step 1: Calculation of … Coupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ... Coupon Rate of a Bond (Formula, Definition) | Calculate ... The bond price varies based on the coupon rate and the prevailing market rate of interest. If the coupon rate is lower than the market interest rate, then the bond is said to be traded at a discount, while the bond is said to be traded at a premium if the coupon rate is higher than the market interest rate.

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Post a Comment for "42 how to calculate coupon rate from yield"