45 pricing zero coupon bonds

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Cube Bank intends to subscribe to a 10-year this Bond having a face value of $1000 per bond. The Yield to Maturity is given as 8%. Accordingly, Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years. Divide the $1,000 by $500 gives us 2. Raise 2 to the 1/30th power and you get 1.02329. Subtract 1, and you have 0.02329, which is 2.3239%. Advantages of Zero-coupon Bonds Most bonds typically pay out a coupon every six months.

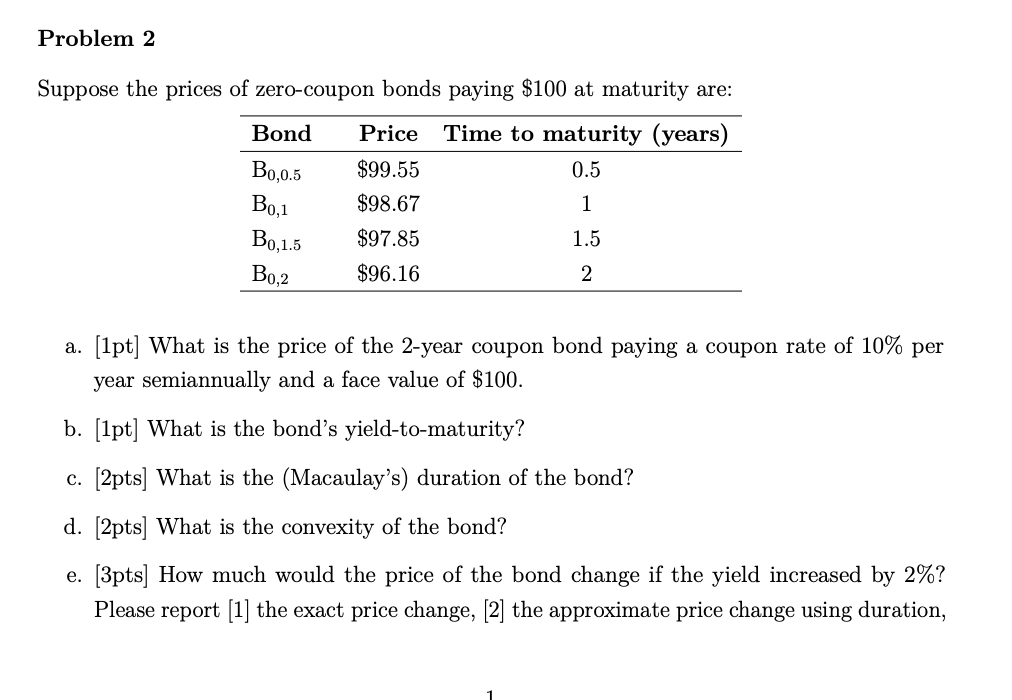

Bootstrapping | How to Construct a Zero Coupon Yield Curve in ... Let us consider a set of zero-coupon bonds of face value $ 100, with maturity 6 months, 9 months and 1 year. The bonds are zero-coupon i.e. they do not pay any coupon during the tenure. The prices of the bonds are as below:

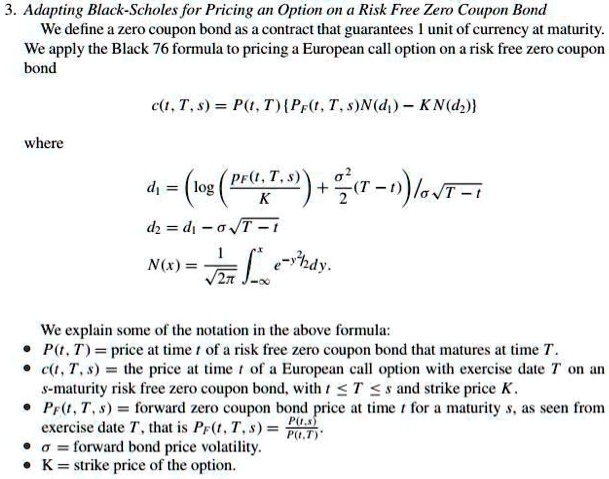

Pricing zero coupon bonds

The Zero Coupon Bond: Pricing and Charactertistics This means if we pay something around $72 (100-28) on December 1, 1996 for the $100 coupon due on December 1, 2001, we will earn something around 30% over the period or 6% a year. Pulling out our trusty bond calculator, we can actually do the calculation. At a semi-annual yield of 5.6%, the price works out to be $75.91. Zero Coupon Bond - Explained - The Business Professor, LLC Unlike the regular, coupon-paying bonds, a zero-coupon bond has an imputed interest rate (rather than an established interest rate). To illustrate, if a bond with a face value of $1,000 matures in 20 years with a 5.5% annual yield, can be purchased at $3,378. This represents $1,000 in value in 20 years if the money compounds annually for 20 years. Zero Coupon Bonds Explained (With Examples) - Fervent The value of a zero coupon bond is nothing but the Present Value of its Par Value. Zero Coupon Bond Example Valuation (Swindon Plc) Consider an example of Swindon PLC, which is issuing a zero coupon bond with a par value of £100 to be paid in one year's time. What is the price of this bond today, if the yield is 7%?

Pricing zero coupon bonds. What Is a Zero-Coupon Bond? Definition, Advantages, Risks A zero-coupon bond is a discounted investment that can help you save for a specific future goal. Tara Mastroeni. Updated. Jul 28, 2022, 9:13 AM. Buying zero-coupon bonds can be a good deal for ... Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Perhaps the most familiar zero-coupon bonds for many investors are the old Series EE savings bonds, which were often given as gifts to small children. These bonds were popular because... Zero-Coupon Bond - Definition, How It Works, Formula Jan 28, 2022 · Therefore, a zero-coupon bond must trade at a discount because the issuer must offer a return to the investor for purchasing the bond. Pricing Zero-Coupon Bonds. To calculate the price of a zero-coupon bond, use the following formula: Where: Face value is the future value (maturity value) of the bond; r is the required rate of return or ... Zero Coupon Bond Value - Formula (with Calculator) - finance formulas A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

How Premium Bonds are Priced | Zero Coupon Bond | Savings - PFhub Let's consider a zero coupon bond with a par value of $5,000 and a maturity period of 5 years. Let's assume that the required rate of return is 10%. Plugging these values in the bond pricing formula: Price = [$5,000 / (1+.05)^10] = $3069.5 Compare this price with the price of the plain vanilla bond that we calculated in the last example. Yield Curves for Zero-Coupon Bonds - Bank of Canada These files contain daily yields curves for zero-coupon bonds, generated using pricing data for Government of Canada bonds and treasury bills. Each row is a single zero-coupon yield curve, with terms to maturity ranging from 0.25 years (column 1) to 30.00 years (column 120). The data are expressed as decimals (e.g. 0.0500 = 5.00% yield). Zero-Coupon Bond Value | Formula, Example, Analysis, Calculator The value of a zero-coupon bond is determined by its face value, maturity date, and the prevailing interest rate. The formula to calculate the value of a zero-coupon bond is. Price = M / (1+r)n. where: M = maturity value or face value of the bond. r = rate of interest required. n = number of years to maturity. 3. Zero-Coupon Bonds: Characteristics and Examples - Wall Street Prep To calculate the price of a zero-coupon bond - i.e. the present value (PV) - the first step is to find the bond's future value (FV), which is most often $1,000. The next step is to add the yield-to-maturity (YTM) to one and then raise it to the power of the number of compounding periods.

Zero Coupon Bond: Formula & Examples - Study.com The prices of zero-coupon bonds are more volatile compared to coupon bonds. Pricing. Maturity dates and interest rates dictate the price of zero coupon bonds. When interest rates are higher, the ... How to Calculate the Price of a Zero Coupon Bond The lower the price you pay for the zero-coupon bond, the higher your rate of return will be. For example, if a bond has a face value of $1,000, you'll earn a higher rate of return if you can buy it for $900 instead of $920. Calculating Zero-Coupon Bond Price. What Is a Zero-Coupon Bond? - Investopedia May 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ... (PDF) Pricing of Zero-coupon and Coupon Cat Bonds Abstract and Figures. We apply the results of Baryshnikov, Mayo and Taylor (1998) to calculate non-arbitrage prices of a zero-coupon and coupon CAT bond. First, we derive pricing formulae in the ...

What is a Zero Coupon Bond? Who Should Invest? | Scripbox Zero coupon bonds are fixed income securities that don't pay any interest. At the time of maturity, the investor is paid the face value or par value. These bonds come with 10-15 years maturity.Hence, they trade at a deep discount. The bond pricing varies with time to maturity.. The higher the time until maturity, lower will be the price the investor will be willing to pay.

What are Zero-Coupon Bonds? (Definition, Formula, Example, Advantages ... The calculation of the price of a bond is given in two illustrations below: Annual Compounding Bonds Mr. Tee is looking to purchase a zero-coupon bond with a face value of $50 and 5 years till maturity. The interest rate on the bond is 2% and will be compounded annually. In the scenario above, the face value of the bond is $50.

How Bond Market Pricing Works - Investopedia Aug 31, 2020 · How to Calculate Yield to Maturity of a Zero-Coupon Bond. ETF News. Best Treasury ETFs for Q4 2022. ... The spot rate Treasury curve can be used as a benchmark for pricing bonds. more.

Interest Rate Statistics | U.S. Department of the Treasury To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate during the period of time in which Treasury did not issue the 30-year bonds. Detailed information is provided with the data

Zero Coupon Bond | Investor.gov Because zero coupon bonds pay no interest until maturity, their prices fluctuate more than other types of bonds in the secondary market. In addition, although no payments are made on zero coupon bonds until they mature, investors may still have to pay federal, state, and local income tax on the imputed or "phantom" interest that accrues each year.

What Is a Zero-Coupon Bond? Definition, Characteristics & Example Typically, the following formula is used to calculate the sale price of a zero-coupon bond based on its face value and maturity date. Zero-Coupon Bond Price Formula Sale Price =...

Zero Coupon Bond Calculator - Nerd Counter Now come to a zero coupon bond example, if the face value is $2000 and the interest rate is 20%, we will calculate the price of a zero coupon bond that matures in 10 years. Then, the under the given procedure will be applied to get the required answer easily: $2000 (1+.2)10 $2000 6.1917364224 $323.01

Bond Pricing - Formula, How to Calculate a Bond's Price A zero-coupon bond pays no coupons but will guarantee the principal at maturity. Purchasers of zero-coupon bonds earn interest by the bond being sold at a discount to its par value. A coupon-bearing bond pays coupons each period, and a coupon plus principal at maturity. The price of a bond comprises all these payments discounted at the yield to ...

The One-Minute Guide to Zero Coupon Bonds | FINRA.org will likely fall. Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond with a face value of $10,000. After 20 years, the issuer of the bond pays you $10,000.

Zero Coupon Bond Calculator - What is the Market Price? - DQYDJ The zero coupon bond price formula is: \frac{P}{(1+r)^t} where: P: The par or face value of the zero coupon bond; r: The interest rate of the bond; t: The time to maturity of the bond; Zero Coupon Bond Pricing Example. Let's walk through an example zero coupon bond pricing calculation for the default inputs in the tool.

How Do Zero Coupon Bonds Work? - SmartAsset Zero Coupon Bond vs. Regular Bond Zero coupon bonds offer the entire payment at maturity but tend to fluctuate in price much more compared to other types of bonds. Because you can purchase the bond at a reduced price, your earnings come from when the bonds mature .

Pricing zero coupon bonds | Python - DataCamp Pricing zero coupon bonds. You have seen that the price of a zero coupon bond is simply the PV of a single cash-flow in the future. How much that single cash-flow is worth today will depend on how far it is into the future and what interest rate (yield) you discount it at. We will investigate this now. To do this, you are going to price a zero ...

How to Buy Zero Coupon Bonds | Finance - Zacks The less you pay for a zero coupon bond, the higher the yield. A bond with a face value of $1,000 purchased for $600 will yield $400 at maturity. Zero coupon bonds are issued by the...

United States Treasury security - Wikipedia Treasury bonds (T-bonds, also called a long bond) have the longest maturity at twenty or thirty years. They have a coupon payment every six months like T-notes. The U.S. federal government suspended issuing 30-year Treasury bonds for four years from February 18, 2002, to February 9, 2006.

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816)

Zero Coupon Bonds Explained (With Examples) - Fervent The value of a zero coupon bond is nothing but the Present Value of its Par Value. Zero Coupon Bond Example Valuation (Swindon Plc) Consider an example of Swindon PLC, which is issuing a zero coupon bond with a par value of £100 to be paid in one year's time. What is the price of this bond today, if the yield is 7%?

Zero Coupon Bond - Explained - The Business Professor, LLC Unlike the regular, coupon-paying bonds, a zero-coupon bond has an imputed interest rate (rather than an established interest rate). To illustrate, if a bond with a face value of $1,000 matures in 20 years with a 5.5% annual yield, can be purchased at $3,378. This represents $1,000 in value in 20 years if the money compounds annually for 20 years.

The Zero Coupon Bond: Pricing and Charactertistics This means if we pay something around $72 (100-28) on December 1, 1996 for the $100 coupon due on December 1, 2001, we will earn something around 30% over the period or 6% a year. Pulling out our trusty bond calculator, we can actually do the calculation. At a semi-annual yield of 5.6%, the price works out to be $75.91.

:max_bytes(150000):strip_icc()/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

![Solved Problem 1 [2pts] Suppose the prices of zero-coupon ...](https://media.cheggcdn.com/media/d09/d093474f-60fc-4291-942a-83c299f0ed41/phpKFnTMF)

Post a Comment for "45 pricing zero coupon bonds"