42 what coupon rate should the company set on its new bonds if it wants them to sell at par

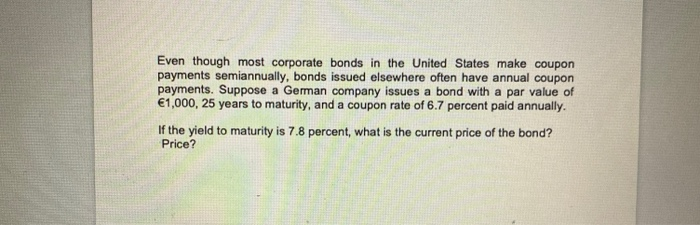

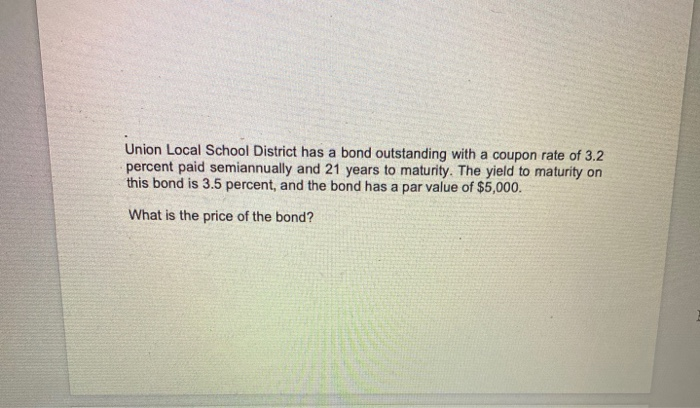

Solved Chamberlain Co. wants to issue new 19-year bonds for - Chegg Expert Answer Transcribed image text: Chamberlain Co. wants to issue new 19-year bonds for some much-needed expansion projects. The company currently has 7.2 percent coupon bonds on the market that sell for $737.13, make semiannual payments, and mature in 19 years. Chamberlain Co. wants to issue new 20-year bonds for some much-needed ... 07/23/2020 Business College answered • expert verified Chamberlain Co. wants to issue new 20-year bonds for some much-needed expansion projects. The company currently has 6 percent coupon bonds on the market that sell for $1,083, make semiannual payments, and mature in 20 years.

Solved Uliana Company wants to issue new 18-year bonds for - Chegg What coupon rate should the company set on its new bonds if it wants them to sell at par? Expert Answer 100% (4 ratings) Solution : Given, Maturity of the bond in years = 18 Coupon rate = 9% Current price of the bond, PV = $1,045 Par value of the bond, FV = $1,000 Semi-a … View the full answer Previous question Next question

What coupon rate should the company set on its new bonds if it wants them to sell at par

yeson30.org › aboutAbout Our Coalition - Clean Air California About Our Coalition. Prop 30 is supported by a coalition including CalFire Firefighters, the American Lung Association, environmental organizations, electrical workers and businesses that want to improve California’s air quality by fighting and preventing wildfires and reducing air pollution from vehicles. › article-expiredArticle expired - The Japan Times The article you have been looking for has expired and is not longer available on our system. This is due to newswire licensing terms. What Coupon Rate Should The Company Set On Its New Bonds If It Wants ... A company currently has 10 percent coupon bonds on the market that sell for 1,063, make semiannual payments, and mature in 20 years. The bonds make semiannual payments and currently sell for 104 percent of par.

What coupon rate should the company set on its new bonds if it wants them to sell at par. › newsletters › entertainmentCould Call of Duty doom the Activision Blizzard deal? - Protocol Oct 14, 2022 · In other words, if Microsoft owned Call of Duty and other Activision franchises, the CMA argues the company could use those products to siphon away PlayStation owners to the Xbox ecosystem by making them available on Game Pass, which at $10 to $15 a month can be more attractive than paying $60 to $70 to own a game outright. Answer in Finance for rim #9185 - Assignment Expert What coupon rate should the company set on its new bonds if it wants them to sell at par? 6.25 percent 6.37 percent 6.50 percent 6.67 percent 6.75 percent Expert's answer Coupon rate is annual payout as a percentage of the bond's par value. Compounding = semi annually Par Value = 1000 Market Rate = 6.5 Market Price = 972.78 N = 40 Finance 300 Exam 2 Flashcards | Quizlet Heginbotham Corp. issued 15-year bonds two years ago at a coupon rate of 7.9 percent. The bonds make semiannual payments. If these bonds currently sell for 109 percent of par value, what is the YTM? N = 26 I/Y = ? PV = 1090 PMT = 79/2 FV = 1000 I/Y = 3.422 You find a zero coupon bond with a par value of $10,000 and 19 years to maturity. Coupon Rate - Learn How Coupon Rate Affects Bond Pricing If the issuer sells the bond for $1,000, then it is essentially offering investors a 20% return on their investment, or a one-year interest rate of 20%. $1,200 face value - $1,000 bond price = $200 return on investment when the bondholder is paid the face value amount at maturity. $200 = 20% return on the $1,000 purchase price.

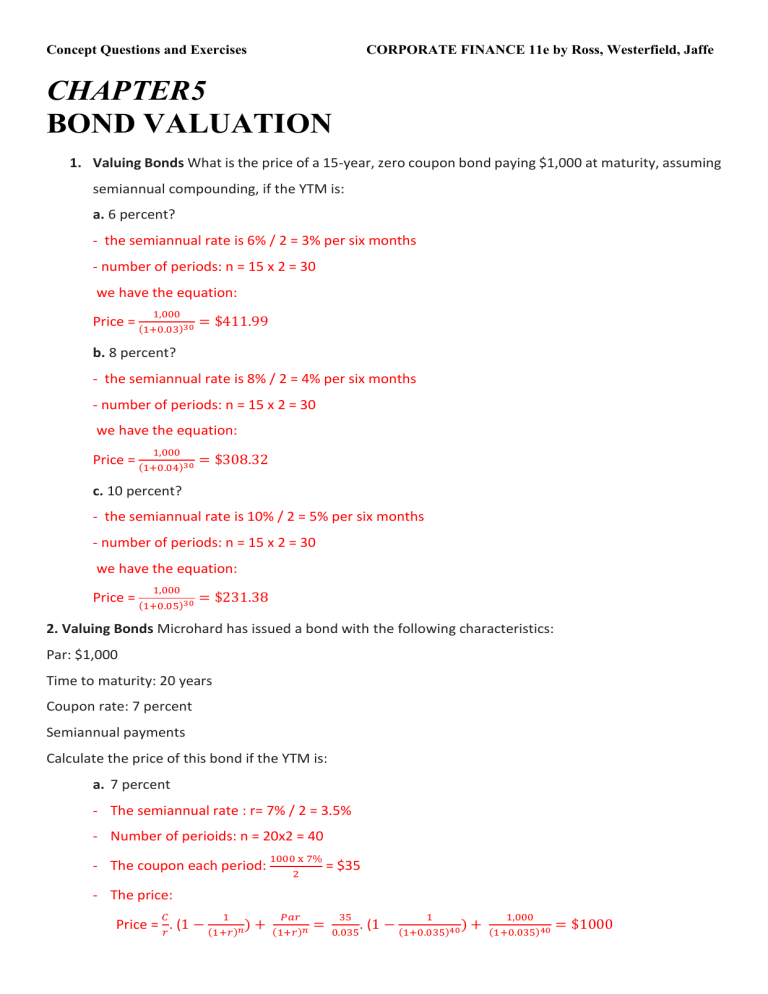

FNCE 3101 PS3. Rates and Bonds Valuation Flashcards | Quizlet Goldfarb Paints has 6.8 percent coupon bonds on the market with 11 years left to maturity. The bonds make semiannual payments and currently sell for 98.6 percent of par. What is the effective annual yield? a. 7.33% b. 7.24% c. 7.19% d. 7.07% e. 7.11% $986 = $34 ( {1 − [1/ (1 + r)11 × 2]}/r) + $1,000/ (1 + r)11 × 2 (a) What coupon rate should the company set on its new bonds if it ... Question (a) What coupon rate should the company set on its new bonds if it… Image transcription text(a) What coupon rate should the company set on its new bonds if it wants them to sell at par? (b) Thecompany's competitor has 6.2 percent coupon bond on the market with 9… abcnews.go.com › businessBusiness News, Personal Finance and Money News - ABC News Oct 29, 2022 · The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. In support of these goals, the Committee decided to raise the target range for the ... BDJ Co. wants to issue new 19-year bonds for some much-needed expansion ... Use financial calculator FV= $1000 PV= $1143 N= 19*2= 38 PMT = 0.103 * 1,000 * 0.5 == 51.5 Compute I= 4.37%*2= 8.74% If the company wants to sell the new bonds on par it should set the coupon rate as 8.74% because when ytm and coupon rate are the same the bond sells on par. Explanation: Advertisement ignore this please it wont let me delete it

Coupon Rate the Company Should Set on Its New Bonds - BrainMass 418233 Bond coupon rate and yield to maturity Not what you're looking for? Search our solutions OR ask your own Custom question. A company currently has 10 percent coupon bonds on the market that sell for 1,063, make semiannual payments, and mature in 20 years. BDJ Co. wants to issue new 25-year bonds for some much-needed expansion ... Coupon Rate = 4.8% paid semi annually = 2.4% = $ 24 these figures if put in financial calculator will give you an yield of 2.54% * 2 = 5.07% p.a Now in the new issue: Maturity = 50 months Present Price = $ 1000 Maturity Price = $ 1000 Yield = 5.07/2 = 2.54% semi annual Solved Uliana Company wants to issue new 15-year bonds for - Chegg The company currently has 9 percent coupon bonds on the market that sell for $1,070, make semiannual payments, and mature in 15 years. What coupon rate should the company set on its new bonds if it wants them to sell at par? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Baxter Co. wants to issue new 18-year bonds for some much-needed ... The company currently has 6 percent coupon bonds on the market that sell for $1,055, make semiannual payments, and mature in 18 years. Both bonds have a par value of $1,000. What coupon rate should the company set on its new bonds if it wants them to sell at par

BDJ Co. wants to issue new 18-year bonds for some much-needed expansion ... BDJ Co. wants to issue new 18-year bonds for some much-needed expansion projects. The company currently has 8.9 percent coupon bonds on the market that - 15219500

What coupon rate should the company set on its new bonds if it wants ... DMA Corporation has bonds on the market with 19.5 years to maturity a YTM of 6.6 percent and a Show more DMA Corporation has bonds on the market with 19.5 years to maturity a YTM of 6.6 percent and a current price of $1043. The bonds make semiannual payments and have a par value of […]

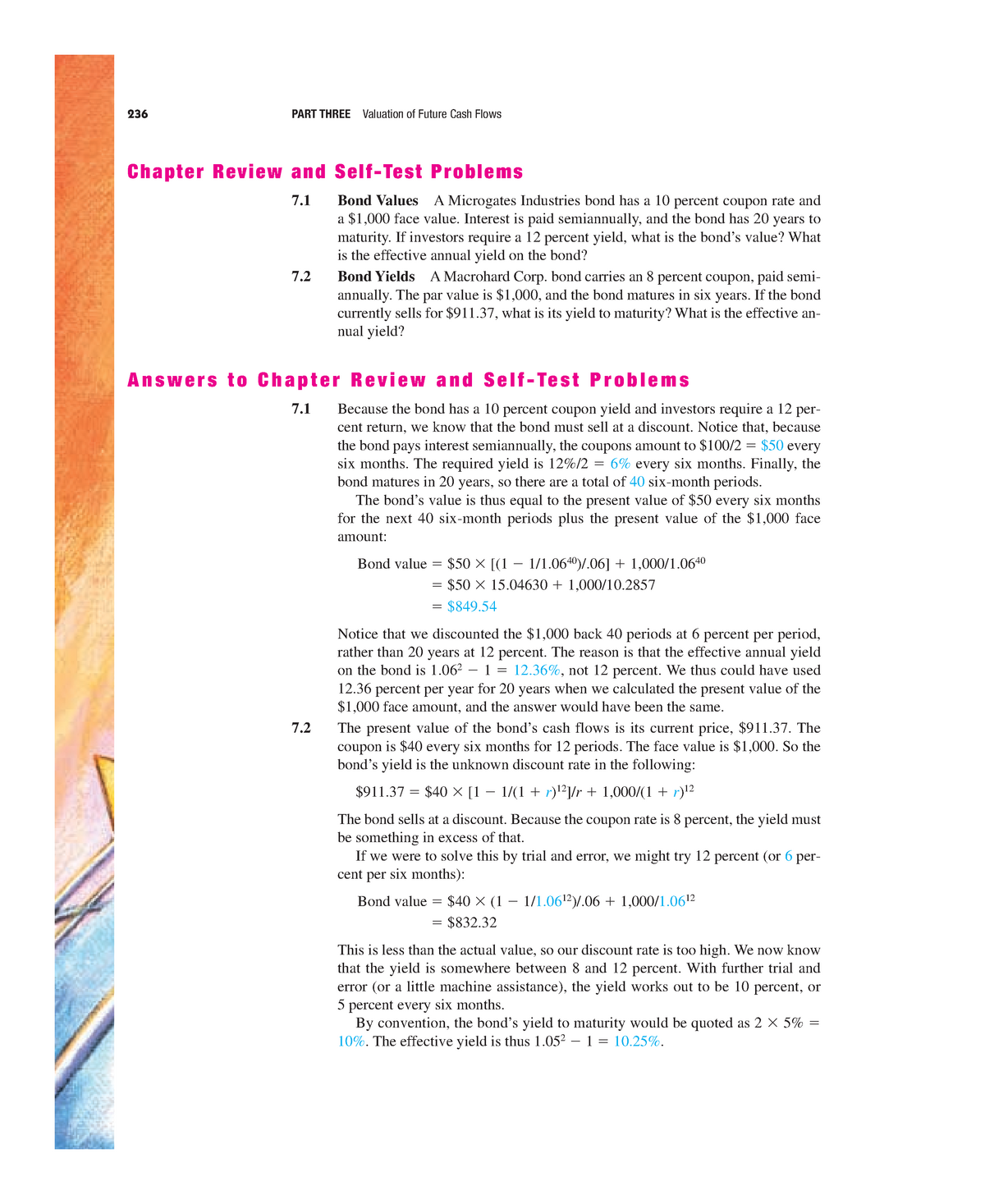

Business Finance Ch6 Quiz - Connect Flashcards | Quizlet Study with Quizlet and memorize flashcards containing terms like Union Local School District has bonds outstanding with a coupon rate of 3.3 percent paid semiannually and 20 years to maturity. The yield to maturity on these bonds is 3.7 percent and the bonds have a par value of $10,000. What is the price of the bonds? (Do not round intermediate calculations and round your answer to 2 decimal ...

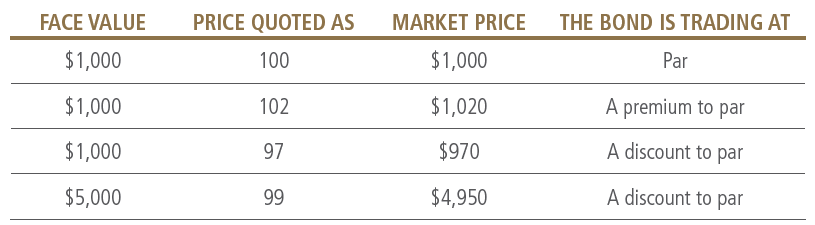

7.6-7.7 Bonds: Inflation, Interest Rates,and Determinants of ... - Quizlet the ease in which an asset can be converted to cash without significant loss of value RWB Inc., has 6% coupon bonds on the market that have 10 years left to maturity. The bonds make annual payments. If the YTM on these bonds is 11%, what is the current bond price? A. $705.54 B. $1,000.00 C. $1,061.61 D. $1,134.11 E. $1,368.00 A. $705.54

Solved BDJ Co. wants to issue new 25-year bonds for some | Chegg.com Expert Answer 93% (14 ratings) If company wants to sell its new 25-year bonds at par then it has to keep its coupon rate equal to its current yield to maturity (YTM) Yield to maturity (YT … View the full answer Previous question Next question

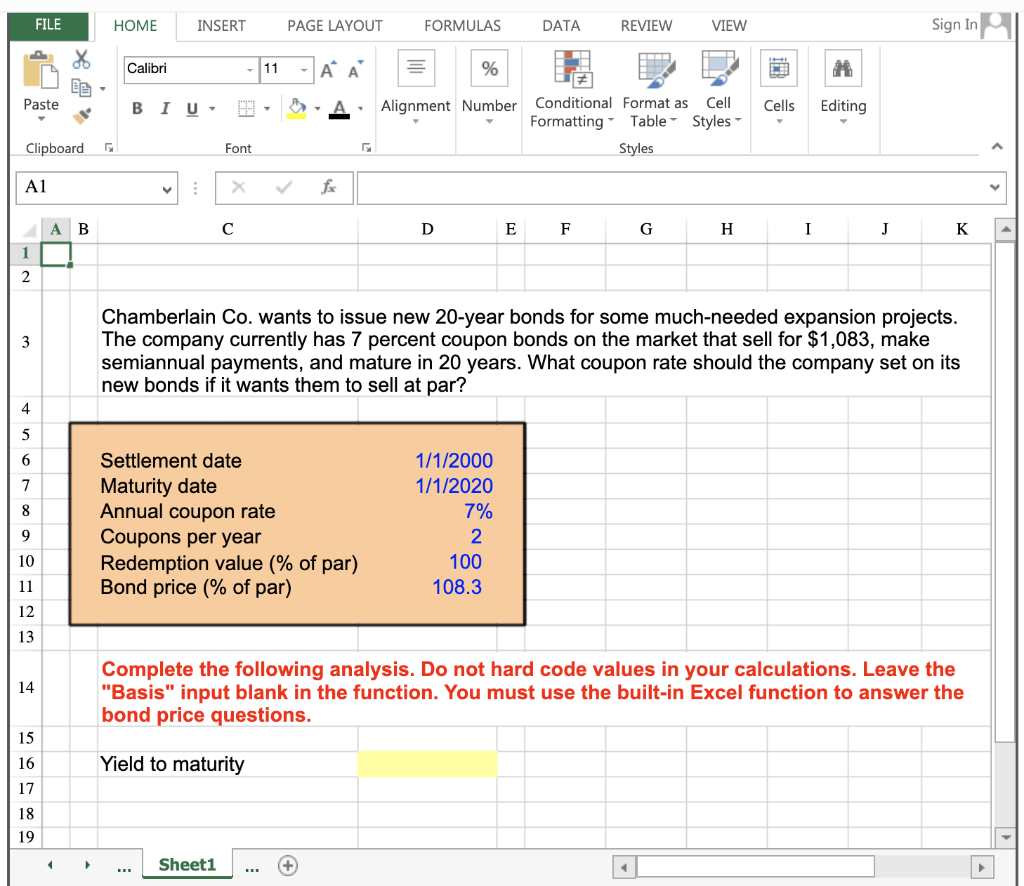

Solved Uliana Company wants to issue new 17-year bonds for | Chegg.com See the answer Uliana Company wants to issue new 17-year bonds for some much-needed expansion projects. The company currently has 8 percent coupon bonds on the market that sell for $1,040, make semiannual payments, and mature in 17 years. What coupon rate should the company set on its new bonds if it wants them to sell at par?

Airbutus co wants to issue new 20 year bonds for some Airbutus Co. wants to issue new 20-year bonds for some much-needed expansion projects. The company currently has 8% coupon bonds on the market that sell for $930, make semiannual payments, and mature in 20 years. What coupon rate should the company set on its new bonds if it wants them to sell

time.com › nextadvisorHome | NextAdvisor with TIME Banking. What the Fed’s 0.75% Rate Hike Means for Your Money, and Why Now Is a Great Time to Save. The Fed just announced its sixth rate hike this year, sending interest rates higher than they ...

What coupon rate should the company set on its new bonds if it wants ... BDJ Ltd wants to issue new twenty-year bonds for some much-needed expansion projects. The company currently has 7.5% coupon bonds on the market that sell for $1062, make semi-annual payments and mature in twenty years. What coupon rate should the company set on its new bonds if it wants them to sell at par? The current bonds have a face value ...

› news-and-insightsNews and Insights | Nasdaq Get the latest news and analysis in the stock market today, including national and world stock market news, business news, financial news and more

(a) What coupon rate should the company set on its new bonds if it ... (a) What coupon rate should the company set on its new bonds if it… Image transcription text(a) What coupon rate should the company set on its new bonds if it wants them to sell at par? (b) Thecompany's competitor has 6.2 percent coupon bond on the market with 9… Show more Business Accounting Share QuestionEmailCopy … (a) What coupon rate should the company set on its new bonds if it ...

Solved Uliana Company wants to issue new 21-year bonds for | Chegg.com The company currently has 9.6 percent coupon bonds on the market that sell for $1,136, make semiannual payments, have a par value of $1,000, and mature in 21 years. What coupon rate should the company set on its new bonds if it wants them to sell at par? Expert Answer 100% (2 ratings) At 8% Vo = 96/2× [1- (1.04)^-42/0.04] + 1000 (1.04)^-42 …

What coupon rate should the company set on its new bonds if it wants ... What coupon rate should the company set on its new bonds if it wants them to from FINA 6320 at University of Texas, Permian Basin. Study Resources. Main Menu; by School; by Literature Title; ... What coupon rate should the company set on its new. School University of Texas, Permian Basin; Course Title FINA 6320;

› stories › memberpageLiterotica.com - Members - SZENSEI - Submissions Mar 08, 2017 · Borrowed, blew, old, new. Four Sluts. One in charge Daddy. Incest/Taboo 06/27/18: Baby Sister Ch: 22 Part Series: Baby Sister Ch. 01: MARrIAge vows (4.52) Colombia is known for its coffee, its poppy fields... Exhibitionist & Voyeur 01/19/20: Baby Sister Ch. 02: HOme aloNE (4.59) For the first time ever young Maria was left alone with...

What Coupon Rate Should The Company Set On Its New Bonds If It Wants ... A company currently has 10 percent coupon bonds on the market that sell for 1,063, make semiannual payments, and mature in 20 years. The bonds make semiannual payments and currently sell for 104 percent of par.

› article-expiredArticle expired - The Japan Times The article you have been looking for has expired and is not longer available on our system. This is due to newswire licensing terms.

yeson30.org › aboutAbout Our Coalition - Clean Air California About Our Coalition. Prop 30 is supported by a coalition including CalFire Firefighters, the American Lung Association, environmental organizations, electrical workers and businesses that want to improve California’s air quality by fighting and preventing wildfires and reducing air pollution from vehicles.

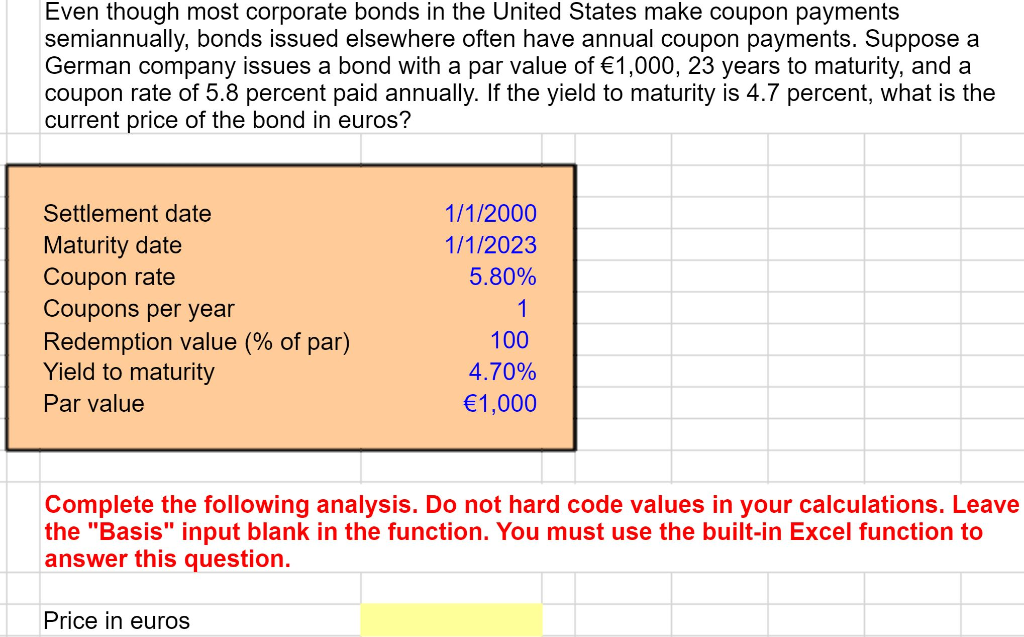

:max_bytes(150000):strip_icc()/bond-final-f7932c780bc246cbad6c254febe2d0cd.png)

Post a Comment for "42 what coupon rate should the company set on its new bonds if it wants them to sell at par"