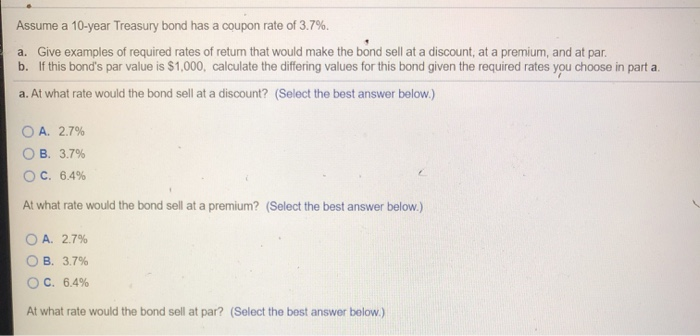

41 coupon rate 10 year treasury

United States Rates & Bonds - Bloomberg Name Coupon Price Yield 1 Month 1 Year Time (EDT) GB3:GOV . 3 Month Interest Rates - U.S. Department of the Treasury Treasury Coupon-Issue and Corporate Bond Yield Curve. Treasury Coupon Issues. Corporate Bond Yield Curve. Federal Financial Data. ... For example, if the 5-year CMT rate was 8.00%, then the annualized effective yield, or APY, would be: APY = (1 + .0800/2) 2-1 APY = 1.081600 -1 APY = 0.081600.

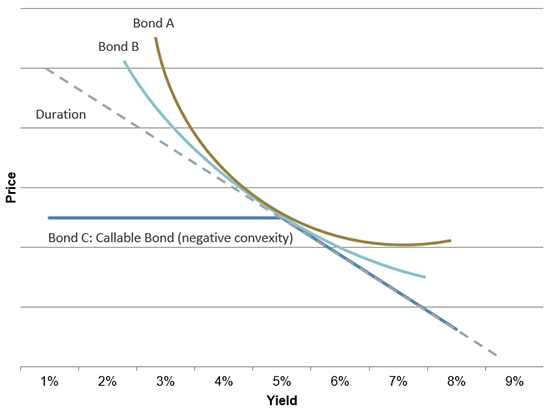

Coupon Rate - Meaning, Example, Types | Yield to Maturity Comparision Therefore, if the 5-Year Treasury Yield becomes 4%, still the coupon rate will remain 5%, and if the 5-Year Treasury Yield increases to 12% yet, the coupon rate will remain 10%. Coupon Rate Vs. Yield to Maturity. Many people get confused between coupon rate and yield to maturity. In reality, both are very different measures of returns. As ...

Coupon rate 10 year treasury

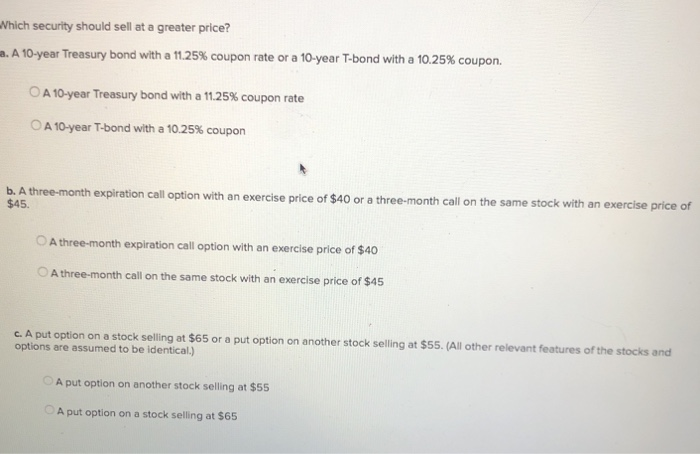

US10Y: U.S. 10 Year Treasury - Stock Price, Quote and News - CNBC Yield Open 4.059% Yield Day High 4.061% Yield Day Low 3.93% Yield Prev Close 4.077% Price 90.4531 Price Change +1.0781 Price Change % +1.207% Price Prev Close 89.375 Price Day High 90.4844 Price... US Treasury Bonds - Fidelity Structure: Coupon or no coupon/discount Investors in Treasury notes (which have shorter-term maturities, from 1 to 10 years) and Treasury bonds (which have maturities of up to 30 years) receive interest payments, known as coupons, on their investment. The coupon rate is fixed at the time of issuance and is paid every six months. How does the U.S. Treasury decide what coupon rate to offer on Treasury ... E.g. if the implied 10yr Trsy yield is 2.03% when the auction happens, the Treasury would set the coupon as 2%. Simple as that. If the coupon were set to 6%, the bond would trade at a huge premium. If the coupon were set to .5%, it would trade at a huge discount. Par is good, because then the dollar value of the Continue Reading Darren Smith

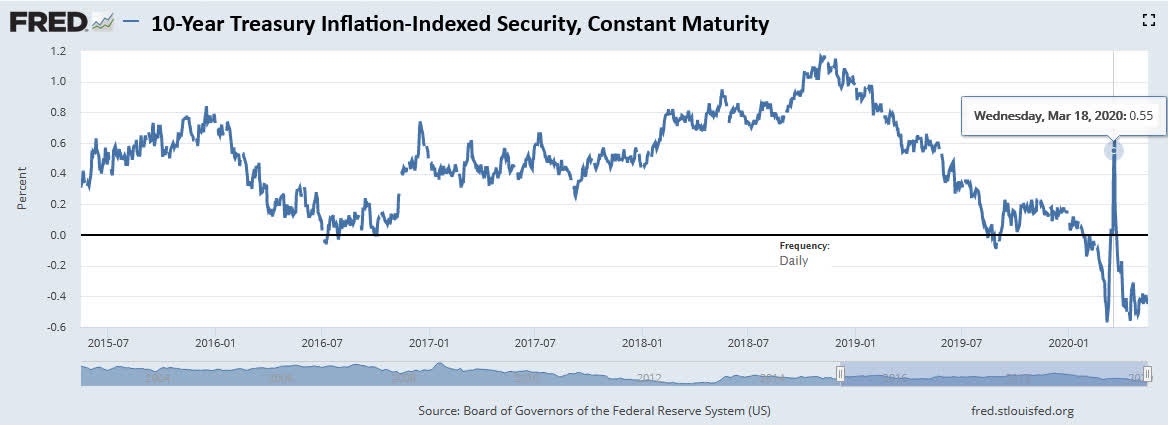

Coupon rate 10 year treasury. Treasury Coupon Issues | U.S. Department of the Treasury TNC Treasury Yield Curve Spot Rates, Quarterly Average: 2018-Present. TNC Treasury Yield Curve Spot Rates, 10-Year Average: 2012 TNC Treasury Yield Curve Spot Rates, 10-Year Average: 2013-2017 TNC Treasury Yield Curve Spot Rates, 10-Year Average: 2018-Present. TNC Treasury Yield Curve Par Yields, Monthly Average: 1976-Present 10-year Treasury yield climbs to fresh 14-year high The yield on the 10-year Treasury hit a fresh 14-year high on Friday, but bonds cut their losses after a report that some Federal Reserve officials are concerned about overtightening with rate ... 10-Year T-Note Overview - CME Group Specs. Margins. Calendar. Among the most actively watched benchmarks in the world, the 10-Year U.S. Treasury Note futures contract offers unrivaled liquidity and capital-efficient, off-balance sheet Treasury exposure, making it an ideal tool for a variety of hedging and risk management applications, including: interest rate hedging, basis ... Treasury Bond (T-Bond) - Overview, Mechanics, Example Treasury Bond Example Current Yield = 1 Year Coupon Payment / Bond Price = $25 / $950 = 2.63% Yield to Maturity (YTM) = 2.83% The yield to maturity (YTM) is essentially the internal rate of return (IRR) earned by an investor who holds the bond until maturity, assuming all coupon payments are made as scheduled and reinvested at the same rate.

10-Year US Treasury Note - Guide, Examples, Importance of 10-Yr Notes When setting the Federal Funds Rate, the Federal Reserve takes into account the current 10-year Treasury rate of return. The yield on the 10-Year Note is the most commonly used Risk-Free Rate for calculating a company's Weighted Average Cost of Capital (WACC) and performing Discounted Cash Flow (DCF) Analysis. Investing in Treasury Notes Coupon Rate of a Bond - WallStreetMojo The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as, Coupon Rate ... Fitted Yield on a 10 Year Zero Coupon Bond (THREEFY10) Board of Governors of the Federal Reserve System (US), Fitted Yield on a 10 Year Zero Coupon Bond [THREEFY10], retrieved from FRED, Federal Reserve Bank of St. Louis; , October 27, 2022. RELEASE TABLES How does the U.S. Treasury decide what coupon rate to offer on Treasury ... E.g. if the implied 10yr Trsy yield is 2.03% when the auction happens, the Treasury would set the coupon as 2%. Simple as that. If the coupon were set to 6%, the bond would trade at a huge premium. If the coupon were set to .5%, it would trade at a huge discount. Par is good, because then the dollar value of the Continue Reading Darren Smith

US Treasury Bonds - Fidelity Structure: Coupon or no coupon/discount Investors in Treasury notes (which have shorter-term maturities, from 1 to 10 years) and Treasury bonds (which have maturities of up to 30 years) receive interest payments, known as coupons, on their investment. The coupon rate is fixed at the time of issuance and is paid every six months. US10Y: U.S. 10 Year Treasury - Stock Price, Quote and News - CNBC Yield Open 4.059% Yield Day High 4.061% Yield Day Low 3.93% Yield Prev Close 4.077% Price 90.4531 Price Change +1.0781 Price Change % +1.207% Price Prev Close 89.375 Price Day High 90.4844 Price...

/10-year-treasury-note-3305795-Final-b5449ca2619747788f6366ccebd81ca7.png)

:max_bytes(150000):strip_icc()/dotdash_INV-final-10-Year-Treasury-Note-June-2021-01-79276d128fa04194842dad288a24f6ef.jpg)

Post a Comment for "41 coupon rate 10 year treasury"